January 17, 2017

Introduction

Credit has become increasingly vital for Americans navigating daily life and planning for the future. Healthy credit can make it easier for people to buy homes and cars, and can potentially save them thousands of dollars a year by opening the door to lower interest rates. In some cases, good credit is necessary to land jobs and apartments. The United States Conference of Mayors and its Council on Metro Economies and the New American City have collaborated with Credit Karma, a personal finance company focused on helping everyone make financial progress, on a series of reports highlighting best credit practices.

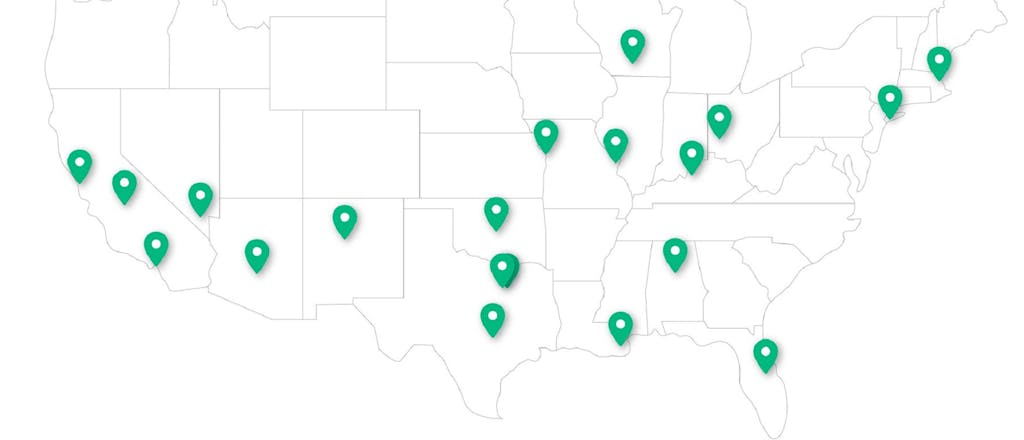

In this brief, Mapping the Credit Landscape in America’s Cities, we benchmark the average amount of mortgage, student loan, auto and credit card debt of people in 20 cities across the country using credit report data from Credit Karma. This is a resource for civic leaders trying to understand how residents in their cities are managing credit. While national statistics can show movement in the overall economy, financial health is often a result of local trends. This information about how real people are managing their credit can be valuable for leaders creating their own initiatives to improve credit health. It is an indicator of how well positioned people in their communities are to make investments in things like homeownership.

This is not a comparison of cities. We have found that despite differences in housing prices, transportation options and percentage of the population still paying for college degrees, financial health can be maintained and even improved. This report is designed as a tool to help leaders tap into financial literacy resources, create local partnerships and track credit trends over time.

The Power of a Credit Score

A credit score is most commonly a three-digit number designed to measure how well a person manages their debts. Credit scores are calculated based on the credit report maintained independently by each of the three major credit bureaus—Equifax, Experian and TransUnion. Higher scores generally indicate greater creditworthiness and may lead to better rates or terms on financial products and insurance coverage. There is no one credit score that lenders typically use, and many financial institutions often use additional financial information (i.e. income or employment history) in their underwriting process.

The average credit score of each city, compared to the average of the 20 cities.

A credit score is not a static number. It can change frequently depending on a number of factors, including:

- Payment History: Late or missed payments, past bankruptcies or defaults are some of the most important factors that can affect a credit score. The best indicator of a consumer’s creditworthiness is often whether they’ve made successful past payments.

- Credit Utilization: The amount of revolving credit — credit cards and some home equity lines of credit — may help identify borrowers that present a greater risk of default. (A common recommendation is to keep the monthly credit balance below 30% of the combined available limits.)

- Length of Credit History: Many credit scoring models reward established credit histories as they may imply more experience managing available credit.

- Diversity of Credit: A combination of installment accounts (i.e. auto, home and student loans) and revolving credit (commonly credit cards) can bolster a credit score. However, it is not typically advised that individuals apply for new lines of credit just to have a variety of account types on a credit report.

- Recent Applications for Credit: Applications for new lines of credit within the last one or two years may result in a decrease to a credit score. It is best to avoid too many “hard inquiries,” or recent applications.

Consumers may keep their credit in good standing by making on-time payments, managing their existing debt responsibly and working to remove possible inaccurate information from their credit reports. Today many consumers have access to free online resources, such as their credit information and financial tools or recommendations. Credit Karma is one of the most popular personal finance tools, used by more than 60 million Americans to monitor their credit, dispute credit report errors and learn about opportunities to save money.

Results

An analysis by Credit Karma of the average credit scores of its members living in 20 cities based on their December 2016 credit report showed the average credit scores in the cities studied ranged from the “poor” to “good” categories, or 580-750 in the commonly used 300-850 credit score range. That means while some people are just getting started and others have established their credit history, there is room for improvement overall. The breakdown of types of credit and how it is being used that follows is meant as a tool for pinpointing the areas where leaders can help individuals move higher on the credit score dial, giving them more opportunities.

Mortgage Debt

Across the country, for those who held mortgages, such mortgages were the largest loan on average that they held. Mortgages also varied the most because of the differences in home prices. Average home loan balances ranged from $113,628 for homeowners in Dayton, Ohio, to $557,826 in San Francisco, California.

For some of these homeowners whose credit scores have improved since they took out their loans or who took out loans when interest rates were higher, refinancing could reduce monthly payments or allow them to put more money toward their principal each month.

Student Loans

Loans taken out to pay for education were also a large part of the debt picture for those who carried it. The average amount of student loan debt for those who had student loans in each of the cities studied varied from a low of $29,506 in Oklahoma City to a high of $49,991 in Boston, Massachusetts.

Long-time student loan holders may have experienced rising credit scores. That means these loans could represent an opportunity for refinancing to secure lower interest rates or payments. Holders of student loan debt should weigh those benefits against any protections offered if it is a federal loan. They should consider income prospects and benefits before refinancing.

Auto Loans

Cars are a part of daily life in most cities. The amount of debt those with car loans carried to pay for their autos ranged from $15,230 in Louisville, Kentucky, to a high of $20,938 in Albuquerque, New Mexico.

Looking beyond these 20 cities, our analysis showed that some 15 million of our 60 million members could save nearly $25 billion collectively, or about $1,700 a person, in interest over the life of their auto loans by refinancing. Our surveys have shown that few people put the time into shopping around for an auto loan that they put into researching car features. Many leave the selection to the auto dealer, who may add a markup to the interest rate. That makes car loans a great place to look for reducing payments.

Credit Cards

The average amount of credit card debt carried by those who had open credit cards varied from a low of $4,776 in Santa Ana, California, to $7,236 in New York City. But the finding that impacts credit scores even more than the dollar amount is the percentage of available revolving credit used. Averages ranged from 31% in San Francisco to 52% in New Orleans, Louisiana.

Keeping usage below 30% of available credit is one primary factor in calculating score, along with other key factors such as on-time payments. This can be achieved by paying down credit cards or opening new lines of credit without increasing the amount owed on those cards. Monitoring activity for inaccurate or out of date information and disputing any errors on a credit report can help manage usage rates reported by the ratings agencies. Keeping credit cards open in good standing can help with both calculating usage percentages and establishing a history of healthy credit activity.

Conclusion

Improving the financial health of a city is something that happens one person at a time, but the first step is understanding where residents are right now. By setting a benchmark for the city, we can point to where applying best practices can have the most success. Individuals can check their credit scores for free at Credit Karma and monitor progress regularly while learning more about how credit works and the steps they can take today to pave the way to a better tomorrow.

The United States Conference of Mayors’ Council on Metro Economies and the New American City promotes investment in U.S. cities and financial education among its residents. The Council publishes it longstanding series of U.S. Metro Economy Reports that forecast economic growth, job generation and wage growth in cities and their metro regions.

Credit Karma is a personal finance company that’s focused on helping everyone make financial progress. Whether they’re interested in getting a better deal on a loan, looking for ways to save, or simply monitoring their credit, Credit Karma offers a range of tools and personalized recommendations designed to help members make the most of their money. Credit Karma services are free to its more than 60 million members, who gain insight into their finances and credit information – and ultimately, improve their financial standing.